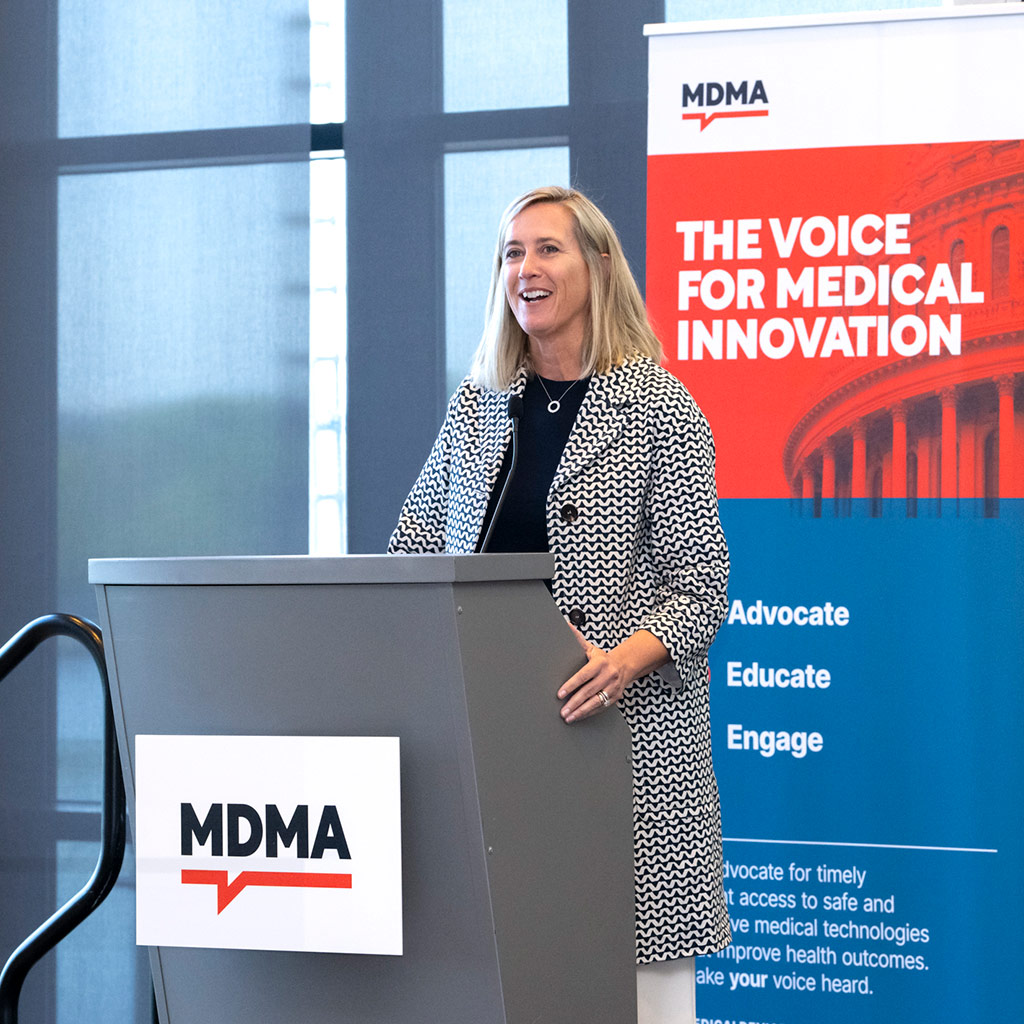

Advocacy & Engagement

How MDMA partners with our members to promote innovation and patient access

Learn more

Our work on key issues

The voice for medical innovation

Learn more about MDMAMDMA Member Stories

MDMA Member Stories

the impact of mdma

the impact

of mdma

Leadership

Saved industry jobs and over $30B with device tax repeal

Mission

Accelerating patient access and improving health outcomes

Network

Hundreds of companies of all sizes championing MedTech innovation

become a member of MDMA

Join hundreds of companies of all sizes that are advancing medical technology innovation. Leverage the network and resources of MDMA to make your voice heard in Washington, DC and beyond!

Latest news

United States and United Kingdom Strike a Trade Deal

16 June 2025

Public Meeting on MDUFA Reauthorization Announced

12 June 2025

Energy & Commerce Committee Examines US Healthcare Supply Chain

11 June 2025

MDMA Submits Comments to CMS on FY2026 IPPS

10 June 2025

MDMA Responds to CMS Deregulatory RFI

10 June 2025

White House Issues HHS Budget Request, House Holds Appropriations Hearing on FDA

5 June 2025